By Sophie Muller

After the most significant climate legislation passed in early August, many communities in Appalachia wanted to know how this act was going to affect their livelihoods. There has been a lot of information regarding how the Inflation Reduction Act of 2022 is going to have many positive impacts in the Appalachian region, including investments for setting the stage for a clean energy revolution, cutting emissions to make air and water cleaner for Appalachian communities, and creating jobs for thousands of people in the region.

We are grateful that the Biden Administration recently launched a new climate portal to help communities navigate climate change impacts–check it out here! This tool provides information on past, present, and future climate conditions. This tool demonstrates how crucial it was to pass the Inflation Reduction Act and we hope our local government officials and city planners use it to understand exposure in the Appalachia so that we can effectively plan and build more resilient infrastructure in our region.

Not only will the Inflation Reduction Act help mitigate the effects of climate change, but Appalachians can save a lot of their utility bills.

Check out these nifty tools below!

Inflation Reduction Act Calculator

How much money will you get with the Inflation Reduction Act? Enter your household information to find out!

The White House: Clean Energy for All

Learn more below on how you or your family can save on utility bills, get support to purchase electric vehicles and energy-saving appliances, and access the economic opportunities of the clean energy future.

Now let’s break down the benefits for each individual state in Appalachia so that our communities can understand how beneficial this historic climate legislation really is.

PENNSYLVANIA

Rebates and tax credits will make it more affordable for Pennsylvania families to purchase energy efficient appliances when they need to, make repairs around their homes, and save money on their utility bills each month. These include rebates covering 50-100% of the cost of installing new electric appliances, tax credits covering 30% of the costs to install solar panels and battery storage systems and other energy efficient home improvements, and grants to help state and local governments adopt the latest building energy codes, which would save the average new homeowner in Pennsylvania 13.5% on their utility bills and $341 annually.

The Inflation Reduction Act will bring an estimated $270 million of investment in large-scale clean power generation and storage to Pennsylvania, which will generate good paying jobs in the clean energy sector. This investment provides bonuses for businesses that pay a prevailing wage, so that Pennsylvania workers are paid well and fairly. It also provides jobs in the manufacturing sector, with investments in clean energy manufacturing and transportation technologies.

Small businesses, which make up 99.6% of all businesses in the state of Pennsylvania, save money through a tax credit that gives money back to businesses that have energy efficiency technology. There’s also a tax credit that covers 30% of the costs of installing low-cost solar power and of purchasing clean trucks and vans for commercial fleets.

The Inflation Reduction Act includes discounts of between $4,000 and $7,500 to purchase electric vehicles, which also reduces the cost of gas for Pennsylvanian citizens.

Also, with goals to reduce greenhouse gas emissions by almost 40% by 2030, there will be cleaner air in PA, resulting in 100,000 fewer asthma attacks, less premature deaths from polluted air, and a general reduction in air pollution.

There will also be many rural opportunities in Pennsylvania following the Inflation Reduction Act, including climate-smart agriculture practices, direct-pay clean energy tax credits, and other investments for rural electric cooperatives, all of which will boost resiliency, reliability, and affordability through clean energy and energy efficiency upgrades.

Finally, the Inflation Reduction Act will upgrade affordable housing, including projects that boost resilience in the face of intensifying extreme weather. In Pennsylvania, tens of thousands of people live in affordable housing units that are eligible for upgrades like flood-proofing and storm resistance and clean energy and electrification. The Inflation Reduction Act also invests in strengthening America’s forests, including programs focused on preventing wildfires and for tree planting projects that help protect communities from extreme heat.

WEST VIRGINIA

In West Virginia, the Inflation Reduction Act offers rebates and tax credits that make it more affordable for families to purchase energy efficient appliances by covering 50-100% of their costs. There are also tax credits that cover 30% of the costs to install solar panels and battery storage systems, make home improvements that reduce energy leakage, or upgrade heating and cooling equipment. The investments include tax credits that cover 30% of the costs of community solar projects—owned by local businesses that sign up families to save on their electric bills—with additional bonus credits of 20% for projects at affordable housing properties and 10% for projects in low-income communities. There are also grants that help state and local governments adopt the latest building energy codes, which would save the average new homeowner in West Virginia 27.4% on their utility bills—$841 annually.

The Inflation Reduction Act will expand job opportunities in the clean energy industry with a $240 million investment in large-scale clean power generation and storage. This investment provides bonuses for businesses that pay a prevailing wage, so that West Virginian workers are paid well and fairly.

Manufacturers employ 45,500 workers in West Virginia, and the Inflation Reduction Act supports local economies and strengthens supply chains by boosting U.S. manufacturing of clean energy and transportation technologies.

There are also tax credits for small businesses that help them save money for energy efficiency improvements, installing low-cost solar power, and purchasing clean trucks and vans for commercial fleets.

The Inflation Reduction Act will make it easier and cheaper to purchase an electric vehicle, with upfront discounts up to $7,500 for new EVs and $4,000 for used EVs, which will help middle-class Americans save on fuel costs.

West Virginia will also benefit from cleaner air, less pollution, and less greenhouse gas emissions, since the Inflation Reduction Act plans to reduce GHG emissions by 30-40% by 2030. In addition to reducing pollution across the economy, the Act will benefit communities most in need of cleaner air, with in environmental justice block grants, investments for cleaner buses and trucks, and a Clean Energy and Sustainability Accelerator that will prioritize emissions-reducing projects in disadvantaged communities.

Finally, the Inflation Reduction Act supports climate-smart agriculture practices, which will help West Virginia’s 22,300 farms lead on climate solutions and reward their stewardship. In West Virginia, tens of thousands of people live in affordable housing units that are eligible for upgrades like flood-proofing and storm resistance, as well as clean energy and electrification. The Inflation Reduction Act will upgrade affordable housing, including projects that boost resilience in the face of intensifying extreme weather.

OHIO

Through rebates, tax credits, and investments, the Inflation Reduction Act will create jobs, advance environmental justice, and lower costs for families in Ohio.

To begin with, buying energy efficient appliances, making energy repairs, and upgrading utility appliances will be much cheaper for Ohio communities through rebates that cover 50-100% of those costs. Tax credits will cover 30% of the costs to install solar panels and battery storage systems, make home improvements that reduce energy leakage, or upgrade heating and cooling equipment. They also cover 30% of the costs of community solar projects. And there are grants to help state and local governments adopt the latest building energy codes, which would save the average new homeowner in Ohio 12% on their utility bills—$261 annually.

The Inflation Reduction Act also creates jobs in the clean energy industry and the manufacturing industries by expanding opportunities in large-scale clean power generation and storage and by bringing an estimated $12.8 billion of investment into Ohio between now and 2030. It provides a historic set of tax credits that include bonuses for businesses that pay a prevailing wage, so that Ohio workers are paid well and fairly.

Ohio is home to 982,035 small businesses, which makes up 99.6% of all businesses in the state. The Inflation Reduction Act will help them save money by providing tax credits with up to $5 per square foot to support energy efficiency improvements that deliver lower utility bills. Other programs will benefit small businesses with tax credits that cover 30% of the costs of installing low cost solar power and of purchasing clean trucks and vans for commercial fleets.

Upfront discounts of between $4,000-$7,500 for purchasing electric vehicles will help millions of people save on fuel costs.

The Inflation Reduction Act plans to reduce greenhouse gas emissions by 30-40% by 2030, significantly reducing pollution and improving air quality, resulting in 100,000 fewer asthma attacks in America in 2030. In addition to reducing pollution across the economy, the Act will benefit communities most in need of cleaner air, with in environmental justice block grants, investments for cleaner buses and trucks, and a Clean Energy and Sustainability Accelerator that will prioritize emissions-reducing projects in disadvantaged communities and fund state and local green banks.

Also, the Inflation Reduction Act supports climate-smart agriculture practices, which will help Ohio’s 76,900 farms lead on climate solutions. And electric cooperatives will for the first time be eligible for direct-pay clean energy tax credits, which serve about 395,000 homes, businesses, and other customers in Ohio.

Finally, the Inflation Reduction Act will upgrade affordable housing, including projects that boost resilience in the face of intensifying extreme weather, which will benefit the thousands of people in Ohio that live in affordable housing units that are eligible for upgrades like flood-proofing and storm resistance.

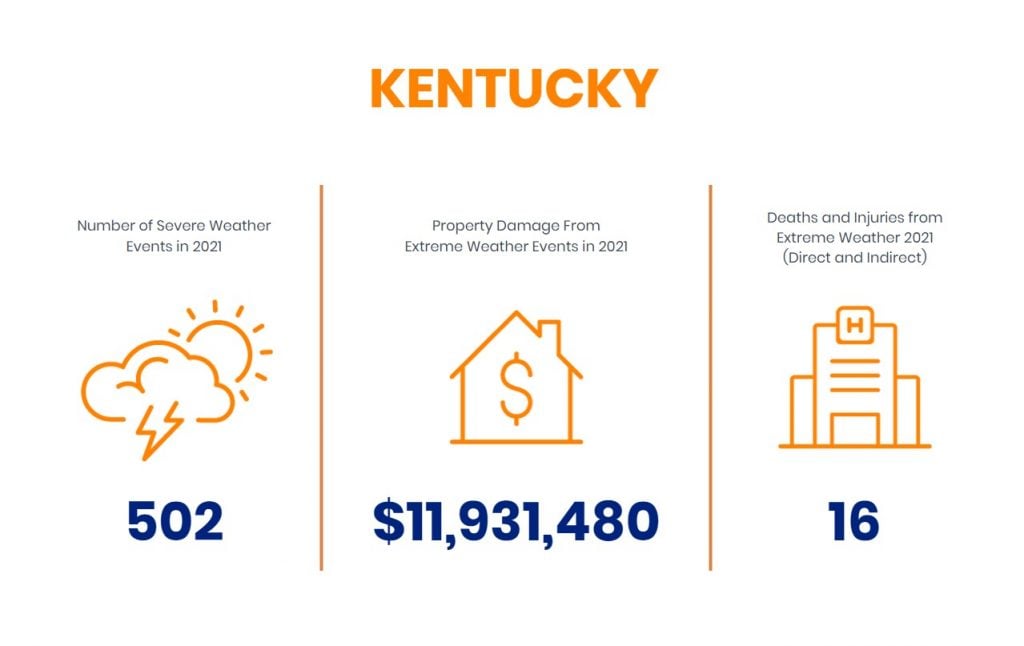

KENTUCKY

The Inflation Reduction Act of 2022 helps Kentucky communities by providing rebates and tax credits to buy and install energy efficient appliances, including super-efficient heat pumps, water heaters, clothes dryers, stoves, and ovens. In Kentucky, hundreds of thousands of low- and moderate-income households are eligible for rebates. Tax credits also cover 30% of the costs to install solar panels and battery storage systems, make home improvements that reduce energy leakage, or upgrade heating and cooling equipment, with no income limits. Grants to help state and local governments adopt the latest building energy codes, which would save the average new homeowner in Kentucky 28.5% on their utility bills—$708 annually.

An estimated $13.9 billion in investments in large-scale clean power generation will expand clean energy and manufacturing job opportunities in Kentucky, and will boost U.S. manufacturing of clean energy and transportation technologies.

The Inflation Reduction Act of 2022 will also help the 360,756 small businesses in Kentucky save money, since small businesses make up 99.3% of all businesses in the state. Commercial building owners can receive a tax credit up to $5 per square foot to support energy efficiency improvements that deliver lower utility bills. Other programs that will benefit small businesses include tax credits covering 30% of the costs of installing low-cost solar power and of purchasing clean trucks and vans for commercial fleets.

Purchasing an electric vehicle will be cheaper and easier to buy as well, with upfront discounts up to $7,500 for new EVs and $4,000 for used EVs, which helps middle-class Kentuckians skip the gas pump and save on fuel costs.

The Inflation Reduction Act will significantly reduce pollution by reducing greenhouse gas emissions by 30-40% by 2030. Lowering greenhouse gas emissions will not only avoid costly climate impacts from more extreme weather, but also improve local air quality—preventing premature deaths and reducing air pollution. In addition to reducing pollution across the economy, the Act will benefit communities most in need of cleaner air, with in environmental justice block grants, investments for cleaner buses and trucks, and a Clean Energy and Sustainability Accelerator that will prioritize emissions-reducing projects in disadvantaged communities.

The Inflation Reduction Act supports climate-smart agriculture practices which boost resiliency, reliability, and affordability, including through clean energy and energy efficiency upgrades. This legislation also dedicates investments for the rural electric cooperatives that serve about 850,000 homes, businesses, and other customers in Kentucky.

Finally, the Inflation Reduction Act will upgrade affordable housing so that the tens of thousands of people who live in affordable housing units can receive upgrades like flood-proofing and storm resistance, as well as clean energy and electrification. The Inflation Reduction Act also invests in strengthening America’s forests, including programs focused on preventing wildfires and for tree planting projects that help protect communities from extreme heat.