By Annie Regan

Our friends at the Financial Consumer Protection Bureau recently shared with us an alarming report entitled, “Consumer Finances in Appalachia,” that highlights the many challenges rural Appalachians face. On average, rural Appalachians earn less than other rural people across the country and significantly less than non-rural consumers. Although this is not entirely surprising due to our history of big corporations coming into our region and exploiting our workforce to only abandon us when their industry goes bankrupt, the numbers are still jarring.

For instance, rural Appalachians are more likely to have a subprime or deep subprime credit score compared to all consumers nationally. Rural Appalachians are also more likely than consumers in other parts of the country to have medical debt collections on their credit record, more student debt loans, and other financial barriers. This report is intended to provide a starting point to better understand the needs and challenges in rural Appalachia and demonstrate the crucial need of federal investment in the region.

Financial Issues Facing Rural Communities:

In March of 2022, the Consumer Financial Protection Bureau invited over 50 people from organizations representing rural people across the county to tell their stories and share their concerns. What came out of those conversations were unfortunately common fixtures found in rural communities that create barriers to financial stability and resiliency.

You can read this on a new effort focused on financial issues facing rural communities.

So what does this mean for Appalachia, specifically?

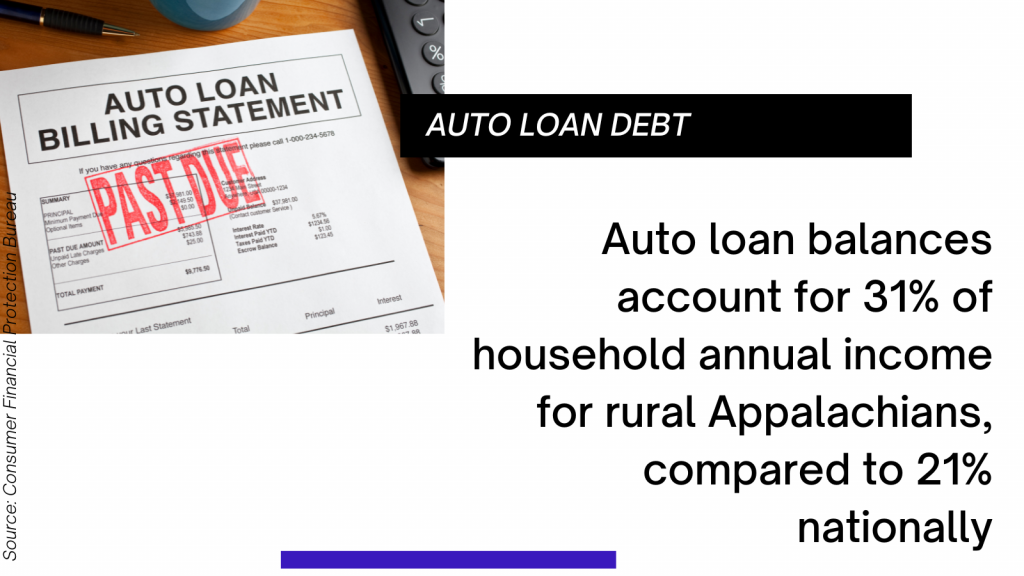

In rural Appalachia, the annual median household income is $48,964. That is more than $21,000 less than the national median of $70,622. The significantly lower household income may lead to more acute debt burdens.

Consumers who have trouble paying for a bill or expense often have multiple financial

difficulties. This is particularly true in rural Appalachia, where, in addition to higher debt burden and cost of credit, there are also disproportionately high levels of medical debt.

More specifically:

All of these factors combined have led to disproportionately high levels of distress in rural

Appalachians’ consumer financial lives. We are glad to hear our friends at the Consumer Federal Protection Bureau will continue to monitor credit conditions in rural Appalachia closely and use its enforcement and regulatory tools as necessary to ensure that the consumer finance market is fair, transparent, and competitive for rural Appalachians. And we will do our part to make sure Appalachians have access to the good paying unions they deserve.

So what can you do?

In addition to voting for elected officials who continue to advocate and vote for bills that bring federal funding to our region, here are a few tangible steps you can take:

STUDENT DEBT RELIEF

If you currently have any student loan debt, you can apply to this Student Debt Relief program that provides eligible borrowers with full or partial discharge of loans up to $20,000 to Federal Pell Grant recipients and up to $10,000 to non-Pell Grant recipients.

Who Qualifies?

- Individuals who made less than $125,000 in 2021 or 2020

- Families that made less than $250,000 in 2021 or 2020

Apply today (but no later than Dec. 31, 2023) and this program will determine your eligibility and you will be contacted if you need to provide more information. Your loan servicer will notify you when your relief has been processed.

TELL YOUR STORY ABOUT A FINANCIAL SERVICE OR PRODUCT

Whether your experience is good or bad, sharing your story/submitting a complaint will help inform the Consumer Financial Protection Bureau work to protect consumers and create a fairer marketplace in rural Appalachia.